aaronburro

Sup, B

52716 Posts

user info

edit post |

no. It's to let state and local gov'ts control it.

tin-foil hat? You don't think there is a bit of indoctrination going on in our schools today?  4/10/2011 11:07:38 PM 4/10/2011 11:07:38 PM

|

Str8Foolish

All American

4852 Posts

user info

edit post |

At least any indoctrination going on in schools is subject to the Democratic bodies making up community schoolboards, and not at the sole discretion of individual parents and whatever wacky beliefs they hold. Anyway, most children coming out of high school believe in American Exceptionalism and it takes a fair amount of deprogramming in college to convince them that free market capitalism doesn't solve all ills. That is to say, they're indoctrinated by default with right-of-center views.

[Edited on April 11, 2011 at 10:44 AM. Reason : .]  4/11/2011 10:43:00 AM 4/11/2011 10:43:00 AM

|

Str8Foolish

All American

4852 Posts

user info

edit post |

Everyone should read the list of policy riders the GOP put in:

http://www.chn.org/pdf/2011/OMB_Watch-HR1_Policy_Riders-1.pdf

It's a joke that they even pretended for a moment they seriously expected it to pass. It's chock full of GOP pet peeve projects and provisions that have little to do with reducing the deficit and everything to do with scoring petty political points with their base.  4/11/2011 10:47:06 AM 4/11/2011 10:47:06 AM

|

HockeyRoman

All American

11811 Posts

user info

edit post |

What I've been looking for is a list of which of those things actually made it into this compromise.  4/11/2011 11:59:20 AM 4/11/2011 11:59:20 AM

|

d357r0y3r

Jimmies: Unrustled

8198 Posts

user info

edit post |

Some days you guys seem so clueless. Trimming a couple percent off the budget isn’t a compromise – they needed to go much, much further. Some of this seems like pure politics, but the debt problem is real. There are serious consequences for regular people if this is not addressed. Both parties are at fault, but the days of ever-expanding government are going to have to end.  4/11/2011 1:32:08 PM 4/11/2011 1:32:08 PM

|

aaronburro

Sup, B

52716 Posts

user info

edit post |

| Quote : | | "It's chock full of GOP pet peeve projects and provisions that have little to do with reducing the deficit and everything to do with scoring petty political points with their base." |

*cough*Obama's Stimulus Legislation*cough* 4/11/2011 7:41:12 PM 4/11/2011 7:41:12 PM

|

Str8Foolish

All American

4852 Posts

user info

edit post |

| Quote : | "

*cough*Obama's Stimulus Legislation*cough*" |

What Democrat pet peeve project was in the stimulus that didn't at least have a nominal justification towards economic progress and/or sustainability?

[Edited on April 12, 2011 at 11:34 AM. Reason : .] 4/12/2011 11:33:57 AM 4/12/2011 11:33:57 AM

|

aaronburro

Sup, B

52716 Posts

user info

edit post |

pet peeve project? really?

the entire porkulous bill was ostensibly about job creation. but pretty much the entire thing was just democrat pet projects. google.com is your friend  4/12/2011 3:31:06 PM 4/12/2011 3:31:06 PM

|

HockeyRoman

All American

11811 Posts

user info

edit post |

I can't wait to see the state level legislation that will undoubtedly come out seeking to eradicate wolf populations. <3 republicans   4/12/2011 3:40:43 PM 4/12/2011 3:40:43 PM

|

pryderi

Suspended

26647 Posts

user info

edit post |

I'll put it in here:

http://thinkprogress.org/2011/05/11/house-wont-honor-troops-killed-bin-laden/

| Quote : | "

The House will not hold a vote on a resolution honoring U.S. troops and the intelligence community on the mission that killed Osama bin Laden, the number-two House Republican said Tuesday.

House Majority Leader Eric Cantor (R-Va.) said that House Republican leaders had been considering a symbolic resolution honoring the Navy SEALS and others involved in the bin Laden raid but that they had decided against one in an effort to keep in line with their new rules prohibiting commemorative measures.

“We considered that last week, and we deal with the rules that we’ve put in place in the House, and we’ve said since we assumed the majority that we want to be substantive and meaningful,” Cantor told reporters at his weekly roundtable." |

http://www.mysanantonio.com/default/article/Bushes-names-added-to-Midland-federal-courthouse-1362444.php#ixzz1M0f0jV8O

| Quote : | | "MIDLAND, Texas (AP) — The U.S. House has voted to add the names of former presidents George H.W. Bush and George W. Bush to the federal courthouse in Midland, where the Bushes once lived." |

that's fucked up 5/11/2011 8:01:09 PM 5/11/2011 8:01:09 PM

|

aaronburro

Sup, B

52716 Posts

user info

edit post |

it was stupid in its own thread. it's stupid in this thread.  5/11/2011 8:12:27 PM 5/11/2011 8:12:27 PM

|

spöokyjon

ℵ

18617 Posts

user info

edit post |

^  5/11/2011 8:31:22 PM 5/11/2011 8:31:22 PM

|

pryderi

Suspended

26647 Posts

user info

edit post |

| Quote : | "federal taxes are at their lowest level in more than 60 years. The Congressional Budget Office estimated that federal taxes would consume just 14.8 percent of G.D.P. this year. The last year in which revenues were lower was 1950, according to the Office of Management and Budget.

The postwar annual average is about 18.5 percent of G.D.P. Revenues averaged 18.2 percent of G.D.P. during Ronald Reagan’s administration; the lowest percentage during that administration was 17.3 percent of G.D.P. in 1984.

In short, by the broadest measure of the tax rate, the current level is unusually low and has been for some time. Revenues were 14.9 percent of G.D.P. in both 2009 and 2010.

Yet if one listens to Republicans, one would think that taxes have never been higher, that an excessive tax burden is the most important constraint holding back economic growth and that a big tax cut is exactly what the economy needs to get growing again.

" |

http://economix.blogs.nytimes.com/2011/05/31/are-taxes-in-the-u-s-high-or-low/ 5/31/2011 8:18:37 PM 5/31/2011 8:18:37 PM

|

eyedrb

All American

5853 Posts

user info

edit post |

you do realize that the bottom half of tax filer pay almost NOTHING.

gotta give the speaker credit for bringing the debt vote up. I think it threw the dems for a curve as they wanted to paint repubs as teh reason the debt limit isnt raised, but now it shows bipartisan support to NOT raise it. So long talking point..well for those who actually pay attention. im sure it will still work on some.  5/31/2011 11:26:52 PM 5/31/2011 11:26:52 PM

|

pryderi

Suspended

26647 Posts

user info

edit post |

| Quote : | | "you do realize that the bottom half of tax filer pay almost NOTHING." |

You do realize that tax cuts to the rich do NOTHING to create jobs. 6/1/2011 1:09:35 AM 6/1/2011 1:09:35 AM

|

eyedrb

All American

5853 Posts

user info

edit post |

If a person who owns a business has MORE of what they earned to spend do you think they are more likely to hire someone vs if they had LESS?

Also, do you think that someone who owns a business is more likely to hire someone than a person who doesnt own a business? (long term employment)

I thought you were discussing tax revenue and not job creation.

Now before you start arguing that the non owner/non rich spend money/buy products which creates jobs(which is true) and the more money they have the more they spend...which is good. You with me so far? Does that same logic apply to the rich? If they have more they spend more too?

So if your logic is to increase consumer spending, which is roughly 2/3 of the economy, then you should also back tax cuts for the "rich". As the top 5% of earners account for 37% of total spending. While the bottom 80% account for 39.5%. And that is with the "rich" paying the lion's share of taxes.  6/1/2011 9:08:58 AM 6/1/2011 9:08:58 AM

|

TerdFerguson

All American

6570 Posts

user info

edit post |

| Quote : | | "gotta give the speaker credit for bringing the debt vote up." |

it wasn't even a real vote 6/1/2011 9:24:32 AM 6/1/2011 9:24:32 AM

|

eyedrb

All American

5853 Posts

user info

edit post |

How so? The dems kept calling to raise the debt limit, so they brought up a vote to do just that. The only problem was that there was bipartisan support to NOT raise it, so they lose the blame game. It was actually a great tactic.  6/1/2011 9:29:24 AM 6/1/2011 9:29:24 AM

|

TerdFerguson

All American

6570 Posts

user info

edit post |

It was brought to a vote under a "suspension of the rules"-- that means it would have taken 2/3 majority for it to pass. Raising the limit just doesn't have that kind of support and everyone knew there was no hope for it to pass. The faction of corporatist republicans (that will eventually cave and vote to raise the limit) knew they didn't need to vote for it this time because it was unlikely to pass, and they needed to save face with their voters. It was smoke and mirrors to set up the claim that cuts are needed to pass the new limit.

that being said I'm sure democrats will eventually give into some cuts, some cuts are needed no doubt. The only question is the size.  6/1/2011 9:48:07 AM 6/1/2011 9:48:07 AM

|

eyedrb

All American

5853 Posts

user info

edit post |

^I agree with everything you said...other than it wasnt a "real" vote. I think it was necessary to show that simply raising the limit wasnt possible and didnt even have support among Dems. It changes the talking points.

Now they will begin negociating.  6/1/2011 10:03:59 AM 6/1/2011 10:03:59 AM

|

TerdFerguson

All American

6570 Posts

user info

edit post |

You don't think some people might have voted differently if it had more of a chance to pass?  6/1/2011 10:07:48 AM 6/1/2011 10:07:48 AM

|

Lumex

All American

3666 Posts

user info

edit post |

| Quote : | | "you do realize that the bottom half of tax filer pay almost NOTHING" |

What's your point? Even if the threshold were somehow lowered to the bottom 25%, threre would be almost no appreciable increase in tax revenue. 6/1/2011 10:11:57 AM 6/1/2011 10:11:57 AM

|

TKE-Teg

All American

43383 Posts

user info

edit post |

^so? What's so wrong with asking for more people to actually pay taxes. Why should they be exempt?  6/1/2011 11:50:41 AM 6/1/2011 11:50:41 AM

|

pryderi

Suspended

26647 Posts

user info

edit post |

| Quote : | "no. It's to let state and local gov'ts control it.

tin-foil hat? You don't think there is a bit of indoctrination going on in our schools today? " |

http://news.yahoo.com/s/ynews/ynews_ts1253

U.S. history textbooks could soon be flavored heavily with Texas conservatism

| Quote : | "Thomas Jefferson no longer included among writers influencing the nation’s intellectual origins. Jefferson, a deist who helped pioneer the legal theory of the separation of church and state, is not a model founder in the board’s judgment. Among the intellectual forerunners to be highlighted in Jefferson’s place: medieval Catholic philosopher St. Thomas Aquinas, Puritan theologian John Calvin and conservative British law scholar William Blackstone. Heavy emphasis is also to be placed on the founding fathers having been guided by strict Christian beliefs.

" |

| Quote : | | " Meanwhile, the recommendations include an entry listing Confederate General Stonewall Jackson as a role model for effective leadership" |

| Quote : | "A more positive portrayal of Cold War anticommunism. Disgraced anticommunist crusader Joseph McCarthy, the Wisconsin senator censured by the Senate for his aggressive targeting of individual citizens and their civil liberties on the basis of their purported ties to the Communist Party, comes in for partial rehabilitation. The board recommends that textbooks refer to documents published since McCarthy’s death and the fall of the Soviet bloc that appear to show expansive Soviet designs to undermine the U.S. government.

" |

6/1/2011 1:06:35 PM 6/1/2011 1:06:35 PM

|

Lumex

All American

3666 Posts

user info

edit post |

| Quote : | | "^so? What's so wrong with asking for more people to actually pay taxes. Why should they be exempt?" |

That's all fine, but that doesn't seem to be the point he was making. The context was tax revenues.

Now I'm going to respond to your new point: People who aren't paying federal income tax aren't exempt. They still pay state income tax, sales tax, excise taxes, property taxes, payroll tax, social security, medicare, vehicle taxes, capital gains taxes, etc. Even if they aren't paying these things directly, the cost of their basic necessities is affected. Federal income tax doesn't even account for half of federal tax revenue.

Also, this "half of tax-payers owe no federal income tax" thing is a very recent circumstance, caused by the economic recession. Does the fact that we have MORE poor people than before mean that we should increase their tax burden? There are plenty of good reasons for spreading the tax burden, but that isn't one of them.

[Edited on June 1, 2011 at 1:47 PM. Reason : .] 6/1/2011 1:30:16 PM 6/1/2011 1:30:16 PM

|

TKE-Teg

All American

43383 Posts

user info

edit post |

^yeah I wasn't stating that as an argument to cut taxes.  6/1/2011 1:52:58 PM 6/1/2011 1:52:58 PM

|

eyedrb

All American

5853 Posts

user info

edit post |

| Quote : | "The context was tax revenues.

" |

So to extend the bush tax cuts "cost" more to apply it to those making over 250k or under?

Let me ask it a different way, soley related to tax revenue. Which is a greater "catch"? 463B or 81B?

As for cutting taxes, I will always tend to side on letting people keep more of what they earn. Esp when the govt has shown no restraint in its own growth and spending.

Lumex, why not have everyone pay the same rate? End all this classwarfare bs. I dont remember anyone getting upset at teh checkout line on how much someone else is paying in sales tax. 6/1/2011 2:12:45 PM 6/1/2011 2:12:45 PM

|

Kris

All American

36908 Posts

user info

edit post |

| Quote : | | "As for cutting taxes, I will always tend to side on letting people keep more of what they earn. Esp when the govt has shown no restraint in its own growth and spending" |

Of course you do, and it shows your dishonesty. You don't actually care about the debt. You just want to shrink the size of the government and the debt is the boogeyman you try to use to do it with.

| Quote : | | "why not have everyone pay the same rate?" |

It's economically unsound. Progressive income taxes act as a stabilizer and encourage economic growth and stability. 6/1/2011 2:20:28 PM 6/1/2011 2:20:28 PM

|

Lumex

All American

3666 Posts

user info

edit post |

^^I don't know for sure who shoud how much in taxes. If it were up to me, I'd tax citizens based on how much they consume beyond a set amount for basic necessities. However, I don't know how to implement that or if it's even currently possible.

I do know that it's silly to say

| Quote : | | "you do realize that the bottom half of tax filer pay almost NOTHING" |

as a counter to someone pointing out that tax revenues are at their lowest point ever. Taxing the poor is going to have a negligible effect on tax revenues and a significant effect on quality-of-life. Maybe there are good reasons to do that, but not for the sake of increasing revenue.

^^^I didn't say you were. I was pointing out that paying no federal income tax does not make one "exempt" from taxes. 6/1/2011 3:09:10 PM 6/1/2011 3:09:10 PM

|

eyedrb

All American

5853 Posts

user info

edit post |

| Quote : | | "It's economically unsound. Progressive income taxes act as a stabilizer " |

Actually that is factually incorrect. As we keep on relying on fewer and fewer people to pay taxes it destablizes our revenue. Use your common sense here.

As far as the debt, in all honesty, I think you have to have severe cuts in entitlements AND increase taxes on EVERYONE. Simply raising taxes will do nothing to slow govt growth. So yes, I would prefer people choose how to spend their own money vs govt pissing it away for them. Crazy huh. Dont think that is true? How many times have they raised the debt limit?

Lumex, that is a great tax plan. imo Sounds a lot like the fairtax. If you havent looked into it, go to http://www.fairtax.org and read up. I think you will like it.

Tax revenues are NOT at their lowest point ever. Yes if you want to talk about percentage of GDP they are low, but please remember how much our govt has pumped in to inflate that number. With these same tax rates we had the highest revenue in our history.

Here is a great website for you

http://www.usgovernmentrevenue.com/local_revenue#usgs302a

here is the spending

http://www.usgovernmentspending.com/index.php 6/1/2011 5:24:35 PM 6/1/2011 5:24:35 PM

|

Kris

All American

36908 Posts

user info

edit post |

| Quote : | | "Actually that is factually incorrect. As we keep on relying on fewer and fewer people to pay taxes it destablizes our revenue. Use your common sense here." |

That makes no sense. Revenue doesn't have to be stable. 6/1/2011 5:56:32 PM 6/1/2011 5:56:32 PM

|

Lumex

All American

3666 Posts

user info

edit post |

^^Ya I'm aware of FairTax, but so far I have yet to read a proposal that implements it in a way that isn't fraught with problems.  6/1/2011 6:16:14 PM 6/1/2011 6:16:14 PM

|

eyedrb

All American

5853 Posts

user info

edit post |

Kris this might help.

http://online.wsj.com/article/SB10001424052748704604704576220491592684626.html?mod=WSJ_hp_mostpop_read  6/1/2011 10:34:14 PM 6/1/2011 10:34:14 PM

|

Kris

All American

36908 Posts

user info

edit post |

It would help if we were talking about state taxes. States have a tougher time selling bonds, thus rely on more stable revenue.  6/1/2011 11:41:11 PM 6/1/2011 11:41:11 PM

|

eyedrb

All American

5853 Posts

user info

edit post |

"Tax experts say the problems at the state level could spread to Washington, as the highest earners gain a larger share of both national income and the tax burden. The top 1% paid 38% of federal income taxes in 2008, up from 25% in 1991, and they earned 20% of all national income in 2008, up from 13% in 1991, according to the Tax Foundation.

"These revenues have a narcotic effect on legislatures," said Greg Torres, president of MassINC, a nonpartisan think tank. "They become numb to the trend and think the revenue picture is improving, but they don't realize the money is ephemeral."

So you dont see the similiarity of states with the most progressive income taxes that are relying on fewer people to pay the bills as the federal govt doing the same. (other than the fed can print money/inflate the currency)  6/2/2011 10:17:29 AM 6/2/2011 10:17:29 AM

|

aaronburro

Sup, B

52716 Posts

user info

edit post |

| Quote : | | "Meanwhile, the recommendations include an entry listing Confederate General Stonewall Jackson as a role model for effective leadership" |

and the problem with that is... he WAS an effective leader. or is this just more "demonize the Confederacy for wanting the Constitution followed" bullshit?

| Quote : | | "You just want to shrink the size of the government" |

And the problem with that is... right.

| Quote : | | "Progressive income taxes act as a stabilizer and encourage economic growth and stability." |

Too bad that's not true. DOH!

| Quote : | | "Revenue doesn't have to be stable." |

Really? Really... Really? 6/2/2011 10:35:22 AM 6/2/2011 10:35:22 AM

|

pryderi

Suspended

26647 Posts

user info

edit post |

| Quote : | "House GOP Cuts To Nutrition Assistance Equal To One Week Of Bush Tax Cuts For Millionaires

By Pat Garofalo on Jun 2, 2011 at 3:50 pm

House Republicans, as part of their 2012 budget, have proposed dramatic cuts to food assistance programs, including cuts to the Special Supplemental Nutrition Program for Women, Infants, and Children (WIC) that would prevent hundreds of thousands of eligible women and their children from accessing the program. Late last month, the House Appropriations Committee approved more than $830 million in cuts to WIC and millions more in cuts to the Emergency Food Assistance Program and the Commodity Supplemental Food Program.

To cut these programs with so many families still feeling the effects of the Great Recession is a travesty. But to do so after spending tens of billions of dollars to extend tax cuts for the richest 2 percent of Americans, as Republicans forced Congress to do back in December, is even worse. CAP’s Melissa Boteach and Seth Hanlon found that the cost of the GOP cut to WIC is equivalent to the cost of extending the Bush tax cuts for millionaires alone for just one week:

The deal struck last December to extend the tax cuts enacted under President George W. Bush gave the average millionaire a tax break of $139,199 for 2011, according to the Tax Policy Center, or nearly $2,700 per week. Given that about 321,000 households reported incomes of more than $1 million in the most recent year for which there are data from the Internal Revenue Service, that means the Bush tax cuts provide millionaires with about $860 million in tax breaks every week—more than enough to stave off the $833 million in proposed cuts to WIC.

" |

Such a CHRISTIAN thing to do.

37 “Then the righteous will answer him, ‘Lord, when did we see you hungry and feed you, or thirsty and give you something to drink?

38 When did we see you a stranger and invite you in, or needing clothes and clothe you?

39 When did we see you sick or in prison and go to visit you?’

40 “The King will reply, ‘Truly I tell you, whatever you did for one of the least of these brothers and sisters of mine, you did for me.’ 6/3/2011 8:11:31 PM 6/3/2011 8:11:31 PM

|

pryderi

Suspended

26647 Posts

user info

edit post |

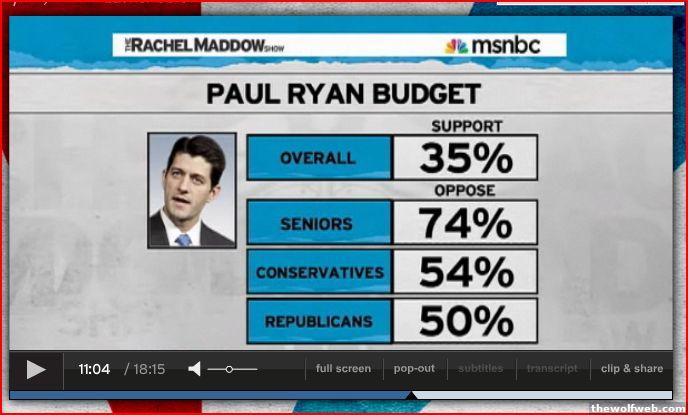

6/3/2011 8:19:09 PM 6/3/2011 8:19:09 PM

|

y0willy0

All American

7863 Posts

user info

edit post |

the rachel maddow show, lol  6/3/2011 8:55:02 PM 6/3/2011 8:55:02 PM

|

Kris

All American

36908 Posts

user info

edit post |

| Quote : | | "So you dont see the similiarity of states with the most progressive income taxes that are relying on fewer people to pay the bills as the federal govt doing the same. (other than the fed can print money/inflate the currency)" |

The federal government is able to easily finance debt, thus it does not need to rely on stable tax revenue. 6/4/2011 10:57:55 AM 6/4/2011 10:57:55 AM

|

moron

All American

33732 Posts

user info

edit post |

| Quote : | | "If it were up to me, I'd tax citizens based on how much they consume beyond a set amount for basic necessities. However, I don't know how to implement that or if it's even currently possible." |

This wouldn’t work in a capitalist system because it disincentives investment and growth. 6/4/2011 12:55:31 PM 6/4/2011 12:55:31 PM

|

pryderi

Suspended

26647 Posts

user info

edit post |

GOP is going to lose the House in 2012.  6/9/2011 12:59:57 PM 6/9/2011 12:59:57 PM

|

CarZin

patent pending

10527 Posts

user info

edit post |

^ Not going to happen.

What that said, I am a republican, but I've come to realization that we simply cant get our finances in order without BOTH cutting significantly government spending and long term obligations at the same time as RAISING taxes on every one. We are too deep in. You dont even need to try and argue Reagonimics. We are way beyond worrying about trickle down, and if it works or not. If we were in a balanced budget situation, then you could discuss it.

Its the nature of conservation... You will spend more and get less. That's what needs to happen with our federal government. Our credit is eroding quickly, and we need to learn to accept less and pay more.

Unfortunately, the republicans are going to think cutting goverment and taxes will make things better, and democrats will think that spending more and taxing more will make things better. Fuck them both.  6/9/2011 3:31:55 PM 6/9/2011 3:31:55 PM

|

Lumex

All American

3666 Posts

user info

edit post |

| Quote : | | "This wouldn’t work in a capitalist system because it disincentives investment and growth." |

I'm not heavily pro-capitalist, if thats what you've inferred from my posts. 6/9/2011 3:56:09 PM 6/9/2011 3:56:09 PM

|

aaronburro

Sup, B

52716 Posts

user info

edit post |

^^ +1  6/9/2011 7:07:59 PM 6/9/2011 7:07:59 PM

|

pryderi

Suspended

26647 Posts

user info

edit post |

| Quote : | | "Unfortunately, the republicans are going to think cutting goverment and taxes will make things better, and democrats will think that spending more and taxing more will make things better." |

You're under the delusion that republicans cut spending.

Look at the years under Bush and GOP congress. 6/9/2011 7:41:14 PM 6/9/2011 7:41:14 PM

|

CarZin

patent pending

10527 Posts

user info

edit post |

There is some truth to your statement, but more deception than truth. While it is true that republicans have loved to spend money on defense, the real issues are the debt that we will take on through entitlement programs, of which all the major ones were put in under democrat rule.

So, yes, republicans have added plenty of debt. But they dont hold a candle to the entitlement programs that are going to really hurt this country.

However, it is my statement that neither party will rise to the task. I think if we could throw them all out at every election, and everyone wasnt worrying about being re-elected, both republicans and democrats could actually make the tough decisions to reform the country.  6/9/2011 8:38:14 PM 6/9/2011 8:38:14 PM

|

roddy

All American

25822 Posts

user info

edit post |

^also, the truth is the Bush era tax cuts are adding trillions to the deficit...they will need to lapse, no way they can be made perm.....need the revenue and they have NOT resulted in job creation.....  6/10/2011 1:06:24 AM 6/10/2011 1:06:24 AM

|

pryderi

Suspended

26647 Posts

user info

edit post |

| Quote : | "The GOP's CIA Playbook: Destabilize Country to Sweep Back Into Power

Obviously, given the wealth of the American elites, the relative proportion of the propaganda funding is derived more domestically in the United States than it would be in a place like Chile (or some other unfortunate Third World country that has gotten on Washington’s bad side).

But the concept remains the same: Control as much as possible what the population gets to see and hear; create chaos for your opponent’s government, economically and politically; blame if for the mess; and establish in the minds of the voters that their only way out is to submit, that the pain will stop once your side is back in power.

Today’s Republicans have fully embraced this concept of political warfare, whereas the Democrats generally have tried to play by the old rules, acquiescing when Republicans are in office with the goal of “making government work,” even if the Republicans are setting the agenda.

" |

http://www.alternet.org/teaparty/151209/the_gop's_cia_playbook%3A_destabilize_country_to_sweep_back_into_power/ 6/13/2011 4:04:07 PM 6/13/2011 4:04:07 PM

|

kdogg(c)

All American

3494 Posts

user info

edit post |

http://en.wikipedia.org/wiki/AlterNet

| Quote : | "AlterNet, a project of the non-profit Independent Media Institute, is a progressive/liberal activist news service. Launched in 1998, AlterNet now claims a readership of over 3 million visitors per month (the web ratings service Quantcast estimates that it receives 1.3 million).

AlterNet publishes original content as well as journalism from a wide variety of other sources. AlterNet states that its mission is to "inspire citizen action and advocacy on the environment, human rights and civil liberties, social justice, media, and health care issues."

AlterNet's tagline is "The Mix is the Message."

AlterNet publishes original content and also amplifies the best of the alternative media. The editorial staff is headed by founder and executive editor Don Hazen, a former publisher of Mother Jones." |

http://www.narconews.com/hazenstory1.html

| Quote : | "Narco News has obtained internal documents authored by Alternet director Don Hazen and other Alternet staff members that reveal serious violations of the most basic ethical standards for journalists.

Those violations include:

-- The collection of what Alternet calls "bounty" fees for each story it sells on drug policy issues.

-- Alternet's refusal, when asked, to disclose the nature of those reprint fees.

-- Alternet's hiding the existence of those "bounty" fees from the writers of those articles, when Alternet claims to pay the writers 50 percent of all reprint fees.

-- Alternet's consequent non-payment of funds that, according to its own website, rightfully belong to the writers.

-- Alternet's blacklisting of writers (similar to the NY Times blacklist banning work by leaders of the National Writers Union), including when Hazen fantasizes, inaccurately, that a writer has been the source of information leading to a legitimate labor complaint by another writer.

-- Alternet's cavalier theft, on two occasions, of stories from our own publication, and Alternet's dishonesty in having later claimed that it did not offer one of those stories for sale, when, in fact, it did.

-- Alternet's request to staff members that they use false identities to post "positive reviews" of an Alternet product that is for sale on Amazon.com" |

[Edited on June 13, 2011 at 4:32 PM. Reason : bold] 6/13/2011 4:31:19 PM 6/13/2011 4:31:19 PM

|