quagmire02

All American

44225 Posts

user info

edit post |

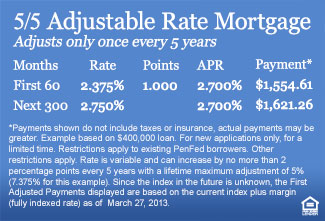

^ points are optional...for me, the 0.75 to bring it down to 2.5% would break even around the 3-year mark...and you have to keep the loan for at least 3 years or else you have to pay back all the "bonuses" (origination, fees, first month's payment, etc)  3/31/2013 10:50:48 AM 3/31/2013 10:50:48 AM

|

Str8BacardiL

************

41737 Posts

user info

edit post |

FUCK

The rates are still going down and I am already locked. WTF.

4/3/2013 3:17:24 PM 4/3/2013 3:17:24 PM

|

Str8BacardiL

************

41737 Posts

user info

edit post |

Why dont they just give out the money for FREEEEEEEEEEEEEE   4/3/2013 3:25:52 PM 4/3/2013 3:25:52 PM

|

quagmire02

All American

44225 Posts

user info

edit post |

^ yeah, but points went up...i locked in at 2.5% and 0.75 points

i'm not very good at math, but i would ASSUME that it's about even in the long run  4/3/2013 3:54:02 PM 4/3/2013 3:54:02 PM

|

Str8BacardiL

************

41737 Posts

user info

edit post |

I think that is what I have too.

They were going to make me up my loan amount to cover the 6000 in CC for the fixed mortgage. (I have the money to just pay but its not "seasoned" in my acct  ) )

We are back to the ARM @2.5%. This should go smoothly, I would have to get royally fucked by an appraiser for it not to.  4/3/2013 5:19:14 PM 4/3/2013 5:19:14 PM

|

H8R

wear sumthin tight

60155 Posts

user info

edit post |

this is all over fb right now:

http://www.washingtonpost.com/business/economy/obama-administration-pushes-banks-to-make-home-loans-to-people-with-weaker-credit/2013/04/02/a8b4370c-9aef-11e2-a941-a19bce7af755_print.html

| Quote : | "Obama administration pushes banks to make home loans to people with weaker credit

By Zachary A. Goldfarb, Published: April 2

The Obama administration is engaged in a broad push to make more home loans available to people with weaker credit, an effort that officials say will help power the economic recovery but that skeptics say could open the door to the risky lending that caused the housing crash in the first place.

President Obama’s economic advisers and outside experts say the nation’s much-celebrated housing rebound is leaving too many people behind, including young people looking to buy their first homes and individuals with credit records weakened by the recession.

In response, administration officials say they are working to get banks to lend to a wider range of borrowers by taking advantage of taxpayer-backed programs — including those offered by the Federal Housing Administration — that insure home loans against default.

Housing officials are urging the Justice Department to provide assurances to banks, which have become increasingly cautious, that they will not face legal or financial recriminations if they make loans to riskier borrowers who meet government standards but later default.

Officials are also encouraging lenders to use more subjective judgment in determining whether to offer a loan and are seeking to make it easier for people who owe more than their properties are worth to refinance at today’s low interest rates, among other steps.

Obama pledged in his State of the Union address to do more to make sure more Americans can enjoy the benefits of the housing recovery, but critics say encouraging banks to lend as broadly as the administration hopes will sow the seeds of another housing disaster and endanger taxpayer dollars.

“If that were to come to pass, that would open the floodgates to highly excessive risk and would send us right back on the same path we were just trying to recover from,” said Ed Pinto, a resident fellow at the American Enterprise Institute and former top executive at mortgage giant Fannie Mae.

Administration officials say they are looking only to allay unnecessary hesitation among banks and encourage safe lending to borrowers who have the financial wherewithal to pay.

“There’s always a tension that you have to take seriously between providing clarity and rules of the road and not giving any opportunity to restart the kind of irresponsible lending that we saw in the mid-2000s,” said a senior administration official who was not authorized to speak on the record.

The administration’s efforts come in the midst of a housing market that has been surging for the past year but that has been delivering most of the benefits to established homeowners with high credit scores or to investors who have been behind a significant number of new purchases.

“If you were going to tell people in low-income and moderate-income communities and communities of color there was a housing recovery, they would look at you as if you had two heads,” said John Taylor, president of the National Community Reinvestment Coalition, a nonprofit housing organization. “It is very difficult for people of low and moderate incomes to refinance or buy homes.”

Before the crisis, about 40 percent of home buyers were first-time purchasers. That’s down to 30 percent, according to the National Association of Realtors.

From 2007 through 2012, new-home purchases fell 30 percent for people with credit scores above 780 (out of 800), according to Federal Reserve Governor Elizabeth Duke. But they declined 90 percent for people with scores between 680 and 620 — historically a respectable range for a credit score.

“If the only people who can get a loan have near-perfect credit and are putting down 25 percent, you’re leaving out of the market an entire population of creditworthy folks, which constrains demand and slows the recovery,” said Jim Parrott, who until January was the senior adviser on housing for the White House’s National Economic Council.

One reason, according to policymakers, is that as young people move out of their parents’ homes and start their own households, they will be forced to rent rather than buy, meaning less construction and housing activity. Given housing’s role in building up a family’s wealth, that could have long-lasting consequences.

“I think the ability of newly formed households, which are more likely to have lower incomes or weaker credit scores, to access the mortgage market will make a big difference in the shape of the recovery,” Duke said last month. “Economic improvement will cause household formation to increase, but if credit is hard to get, these will be rental rather than owner-occupied households.”

Deciding which borrowers get loans might seem like something that should be left up to the private market. But since the financial crisis in 2008, the government has shaped most of the housing market, insuring between 80 percent and 90 percent of all new loans, according to the industry publication Inside Mortgage Finance. It has done so primarily through the Federal Housing Administration, which is part of the executive branch, and taxpayer-backed mortgage giants Fannie Mae and Freddie Mac, run by an independent regulator.

The FHA historically has been dedicated to making homeownership affordable for people of moderate means. Under FHA terms, a borrower can get a home loan with a credit score as low as 500 or a down payment as small as 3.5 percent. If borrowers with FHA loans default on their payments, taxpayers are on the line — a guarantee that should provide confidence to banks to lend.

But banks are largely rejecting the lower end of the scale, and the average credit score on FHA loans has stood at about 700. After years of intensifying investigations into wrongdoing in mortgage lending, banks are concerned that they will be held responsible if borrowers cannot pay. Under some circumstances, the FHA can retract its insurance or take other legal action to penalize banks when loans default.

“The financial risk of just one mistake has just become so high that lenders are playing it very, very safe, and many qualified borrowers are paying the price,” said David Stevens, Obama’s former FHA commissioner and now the chief executive of the Mortgage Bankers Association.

The FHA, in coordination with the White House, is working to develop new policies to make clear to banks that they will not lose their guarantees or face other legal action if loans that conform to the program’s standards later default. Officials hope the FHA’s actions will then spur Fannie and Freddie to do the same.

The effort requires sign-on by the Justice Department and the inspector general of Department of Housing and Urban Development, agencies that investigate wrongdoing in mortgage lending.

“We need to align as much as possible with IG and the DOJ moving forward,” FHA Commissioner Carol Galante said. The HUD inspector general and Justice Department declined to comment.

The effort to provide more certainty to banks is just one of several policies the administration is undertaking. The FHA is also urging lenders to take what officials call “compensating factors” into account and use more subjective judgment when deciding whether to make a loan — such as looking at a borrower’s overall savings.

“My view is that there are lots of creditworthy borrowers that are below 720 or 700 — all the way down the credit-score spectrum,” Galante said. “It’s important you look at the totality of that borrower’s ability to pay.” " |

I won't even say it... 4/3/2013 5:22:48 PM 4/3/2013 5:22:48 PM

|

NeuseRvrRat

hello Mr. NSA!

35376 Posts

user info

edit post |

i could've got a way better deal on a mortgage if i made less money   4/3/2013 5:28:54 PM 4/3/2013 5:28:54 PM

|

Douche Bag

Fcuk you

4865 Posts

user info

edit post |

I'm getting 2.95% FIXED for 30 years now...0.75% origination, no discount/buy down points. Super stoked. This is for new purchases only.  4/3/2013 11:51:30 PM 4/3/2013 11:51:30 PM

|

quagmire02

All American

44225 Posts

user info

edit post |

^ nice. with who?  4/4/2013 7:21:21 AM 4/4/2013 7:21:21 AM

|

Douche Bag

Fcuk you

4865 Posts

user info

edit post |

First Federal CreditUnion (no,I'm not a member)

That said, I'm glad I'm buying my dream house now...gonna be huge.  4/4/2013 8:27:39 AM 4/4/2013 8:27:39 AM

|

slut

All American

8357 Posts

user info

edit post |

I kept trying to justify penfed's 3.125 or 3.25%, but the 1% origination fee & points didn't balance out for me until the 10 year mark, even compared to BoA.  4/15/2013 4:04:59 PM 4/15/2013 4:04:59 PM

|

Str8BacardiL

************

41737 Posts

user info

edit post |

I am still waiting on my appraisal to come back. Supposed to close by end of month.  4/15/2013 11:57:02 PM 4/15/2013 11:57:02 PM

|

quagmire02

All American

44225 Posts

user info

edit post |

^ when was it appraised? like i said earlier, mine was done on a friday and reported to penfed on tuesday or wednesday of the following week...but no one told me (the appraiser said they'd send me a copy when they sent it to penfed, but it never happened)

i just called penfed several weeks later and they told me it had been sent them weeks earlier, so i'd suggest giving them a call if it's been a week or more

we're supposed to close on may 1 and i haven't heard back from the lawyers, yet...i was hoping we might get the $1k guaranteed closing date bonus if it's after the 1st, but i think that only applies to purchases, not refis  4/16/2013 11:13:23 AM 4/16/2013 11:13:23 AM

|

Str8BacardiL

************

41737 Posts

user info

edit post |

Did they make you use PenFed Title?  4/16/2013 11:23:57 AM 4/16/2013 11:23:57 AM

|

quagmire02

All American

44225 Posts

user info

edit post |

^ champion title...but that's their title service (i think)  4/16/2013 1:03:53 PM 4/16/2013 1:03:53 PM

|

Str8BacardiL

************

41737 Posts

user info

edit post |

I just checked and you have to use Champion Title to get the CC credit.  4/16/2013 2:20:31 PM 4/16/2013 2:20:31 PM

|

quagmire02

All American

44225 Posts

user info

edit post |

is there a reason you don't want to use champion? the title fee is part of what they cover, so it's not like it costs you anything

i think the only actual money you have to bring to closing are the initial deposit for escrow, daily interest charges, and points (if you opted for that, which i did)

also, regarding the CC, i think you can open it up to (90?) days AFTER closing and they'll give you the bonus related to the closing  4/16/2013 2:25:50 PM 4/16/2013 2:25:50 PM

|

David0603

All American

12759 Posts

user info

edit post |

Yeah, who cares about who does the title?  4/16/2013 3:11:08 PM 4/16/2013 3:11:08 PM

|

quagmire02

All American

44225 Posts

user info

edit post |

closed this morning

had to bring money to closing, but that was a combination of things:

1.) the new mortgage was lower than what was remaining on the old (because when i told them how much i wanted, i thought i'd have made may's payment to SECU by then), so we added a bit there

2.) establishment of escrow (which we'll kinda get back, since SECU needs to give us what they have in escrow), and

3.) some interest (from the beginning of may until june because i guess it's too late to make may's payment?)

penfed paid almost $2200 in closing costs...and they cover june's payment

so...apparently you don't need an attorney to close? champion title was supposed to be one doing it, but over the past couple of weeks there have been some issues with their company, so last week penfed changed to an attorney in north raleigh for all of their closings...the guy we worked with was really nice and went through everything with us

a couple of things were annoying on penfed's end...i didn't have the total to bring to closing until this morning (like 30 minutes before we got to the attorney's office) and then they called while we were signing paperwork to change something...and THEN, 10 minutes after we left, we got an email (not a phone call, which was also annoying...but that was the attorney's assistant's fault) saying penfed had changed two documents and we had to come back to sign them

given the flakiness of our pre-closer at penfed (i had to stay on top of her to remind her about things that needed to be done), i could understand that she might have been the one holding everything up with last-minute changes, but it could also have been their closing department...i hope it doesn't indicate a problem in the long term

all in all, though, we're saving $200/month (including PMI, which is only something like $48/month) over our old mortgage and that's pretty awesome  5/1/2013 12:34:51 PM 5/1/2013 12:34:51 PM

|

Str8BacardiL

************

41737 Posts

user info

edit post |

I just heard from my closer, still do not have a close date but as long as its before the 15th of this month I don't really care. My appraisal went up 28k since the last one in late 2011.   5/1/2013 1:17:09 PM 5/1/2013 1:17:09 PM

|

David0603

All American

12759 Posts

user info

edit post |

| Quote : | | "i didn't have the total to bring to closing until this morning " |

Heh. Same thing happened to me with CFCU. Quite annoying. 5/1/2013 1:36:44 PM 5/1/2013 1:36:44 PM

|

jbrick83

All American

23447 Posts

user info

edit post |

| Quote : | | "so...apparently you don't need an attorney to close?" |

The question of necessity is a personal opinion.

However, it's illegal in SC not to have an attorney at closing as well as not allowing the mortgagee their choice of attorney. It's definitely not followed to a T...but that's the law. 5/1/2013 1:42:59 PM 5/1/2013 1:42:59 PM

|

quagmire02

All American

44225 Posts

user info

edit post |

^ i could be wrong, but i think an attorney is required in NC when it's a purchase, but not when it's a refinance

don't get me wrong, i would opt for an attorney every time...i had thought that the title company was just providing the service of checking on the title and drawing up a new one and that an attorney would do the closing all along...i didn't realize that wasn't the case until the attorney we DID close with told us what had happened with champion title

i need to contact penfed about one item, for clarification...the truth in lending disclosure has a box checked for "introductory rate notice" that says that our current rate of 2.5% ends after 60 payments (5 years)...it then says that the 61st payment will increase to 2.875%, even if market rates do not change

the thing is, this isn't mentioned anywhere else...on all other documents, it notes a lifetime minimum of 2% and a lifetime cap of 7.5%

i don't particularly care...i had seen this before closing and was okay with it because the increase caps are based on the 2.5%...i'm not going to worry about 0.375% that won't come around for 5 years...but it seems to conflict with the notion of an ARM, that rates can go DOWN, as well (i mean, if market rates go down, would my rate go down or is this little clause in there a guarantee that penfed won't lower my rate at all for 10 years?)

anyway, now i need to open my credit card with penfed so i can get my bonus cash monies   5/2/2013 8:39:25 AM 5/2/2013 8:39:25 AM

|

jbrick83

All American

23447 Posts

user info

edit post |

In South Carolina you need an attorney for every closing...regardless of whether its a purchase or refinance.

I did a quick search and I THINK I read that in North Carolina that an attorney is still required, but doesn't have to be physically present (ie, they have to at least prepare their part of the paperwork). I think you can have some leeway in that as well (like using some boilerplate paperwork that was prepared by an attorney at some point, but maybe not this particular transaction).

Oh well...end of sidebar.  5/2/2013 9:07:18 AM 5/2/2013 9:07:18 AM

|

twolfpack3

All American

2573 Posts

user info

edit post |

Yes, the actual attorney does not have to be physically present. It just has to go through an attorney.

Never met the attorney for the first house. For the second house, the attorney actually went through the paperwork with us. As one can imagine, the 2nd attorney was more expensive.  5/2/2013 9:23:02 AM 5/2/2013 9:23:02 AM

|

jbrick83

All American

23447 Posts

user info

edit post |

That makes sense now. I have a cousin who's an attorney in Southeastern NC who told me a few years ago that his Real Estate practice suffered a lot when NC stopped requiring attorneys to be present at closings. Lot of easy money in that.  5/2/2013 9:35:07 AM 5/2/2013 9:35:07 AM

|

Str8BacardiL

************

41737 Posts

user info

edit post |

When I refinanced in 2006 I received the entire loan package by .PDF, signed it, scanned it back and mailed the hard copies in a FedEx envelope. The money was in my account in 2-3 days. I am not sure who actually went to the courthouse to file the docs, there was no local attorney involved, I did it at home and sent it to the lender.

I am not sure if you can still do them that way now, probably not.  5/2/2013 2:41:43 PM 5/2/2013 2:41:43 PM

|

wlb420

All American

9053 Posts

user info

edit post |

PSA to get your FHAs before the june rule changes...less than a month to go  5/6/2013 10:37:21 PM 5/6/2013 10:37:21 PM

|

Douche Bag

Fcuk you

4865 Posts

user info

edit post |

got my official commitment (not pre-commitment) letter today...30 years fixed at 2.95%.

Life is good.  5/10/2013 10:18:35 PM 5/10/2013 10:18:35 PM

|

wdprice3

BinaryBuffonary

45908 Posts

user info

edit post |

nice; wish mine was that low

I got in at 4.125, not bad, but could be better.  5/10/2013 11:07:46 PM 5/10/2013 11:07:46 PM

|

Douche Bag

Fcuk you

4865 Posts

user info

edit post |

My townhouse is at 4.875%, too much of a pain to refinance.

The new house is my big purchase, so I'm grateful to get it so low. When they said they could do 2.95%, I told them to go ahead and do the maximum conventional loan ($417K). 5 weeks later, I'm ready to close. Pretty easy process.  5/11/2013 10:46:16 AM 5/11/2013 10:46:16 AM

|

Str8BacardiL

************

41737 Posts

user info

edit post |

wtf is BayView Loan Servicing LLC??

sounds ghetto  5/13/2013 11:08:44 AM 5/13/2013 11:08:44 AM

|

Douche Bag

Fcuk you

4865 Posts

user info

edit post |

And now I'm a Cary'ite...closed and settling in now :-)  5/25/2013 9:49:35 AM 5/25/2013 9:49:35 AM

|

ncsuapex

SpaceForRent

37776 Posts

user info

edit post |

Great. Just what Cary needs. Another Douche Bag.  5/25/2013 9:56:20 AM 5/25/2013 9:56:20 AM

|

Douche Bag

Fcuk you

4865 Posts

user info

edit post |

^LOL...love it.  5/25/2013 11:17:07 AM 5/25/2013 11:17:07 AM

|

stopdropnrol

All American

3908 Posts

user info

edit post |

What do you guys think about secu and their 2/1 arm vs FHA? Secu does 100% financing with no PMI so despite the higher rate no PMI would save me ~ $120/month plus I could keep my down payment as extra cushion \refi$. Also Any inside info on their loan approval process (I.e. minimum score,required reserves etc.)

*if there's another product out there please recommend it but I'm limited with my less than ideal fico (660 midscore) & just enough to do 3.5% down +closing cost assuming a $125k loan.

[Edited on May 26, 2013 at 11:16 PM. Reason : broke with bad credit disclaimer]  5/26/2013 11:06:27 PM 5/26/2013 11:06:27 PM

|

Douche Bag

Fcuk you

4865 Posts

user info

edit post |

I believe you can go in anytime their rates decrease, pay them a $200 fee and lock in at the new, lower rate. The downside will be when rates start to increase, they'll shoot up. They shoot up like rockets and fall like feathers...with that said, you'll save on the short term, but when the fed says they'll stop quanitative easing (i.e. artificially keeping the interest rate low), rates will jump significantly (1-2 points relatively quickly). I think you are a fool not to lock in the cheapest money for the longest period possible. With that said, I'm a commercial real estate broker, so what do I know?  5/26/2013 11:16:22 PM 5/26/2013 11:16:22 PM

|

dannyp45

All American

1053 Posts

user info

edit post |

^^Too be honest, I think the SECU's 2 yr ARM isn't a bad option for someone in the 660's cbi with little to no down payment. Something that makes it sweeter is if you are a first-time home buyer (or haven't own a home in the last three years) because no origination fee and $1000 to closing. Check out this link to read more about it. The only reason why I didn't get my mortgage through SECU is that they didn't offer a 30 yr Fixed; which if you don't plan on living in the same home for more than 10ish years...no big deal then.

https://www.ncsecu.org/Mortgages/SpecialMortgages.html

Approval process....don't be so worried about the credit score per say or how much you have on deposit (of course they help). There are other factors that they consider...length of employment....willingness to repay on debts...reasonable req....etc. If you are that worried about the application process, rather than do the app online or over the phone, go to your local branch and set up an appointment with them as they are the ones with the power to approve and with a face-to-face meeting...it could play in your favor.

Unfortunately...I don't know enough about FHA loans to give an insight about that. I do know that there is an additional mortgage insurance in the loan on top of the PMI (not sure if this is the case for all FHA loans).  5/28/2013 5:14:45 AM 5/28/2013 5:14:45 AM

|

quagmire02

All American

44225 Posts

user info

edit post |

| Quote : | | "What do you guys think about secu and their 2/1 arm vs FHA? Secu does 100% financing with no PMI so despite the higher rate no PMI would save me ~ $120/month plus I could keep my down payment as extra cushion \refi$. Also Any inside info on their loan approval process (I.e. minimum score,required reserves etc.)" |

i did the 2/1 ARM through SECU for my first mortgage in 2008 (the house i'm still in and just refi'd with penfed)...rate was 4.25% with a 0.50% "penalty" for doing 100%...no origination fee and no PMI, but there were other closing costs and no credit toward closing at the time

in 2008, the lowest fixed i could find that i would qualify for was 6.25% (and putting down 10% would eliminate my cushion), so it seemed like a no-brainer...it stayed at 4.75% for 2 cycles (not that that means anything in regards to what will happen in the future), so it worked out pretty well

i've never done an FHA and i've only just now refi'd (and so my only experience is with the SECU first-time homebuyer loan and penfed's 5/5 ARM)...but the SECU process was fairly painless (better than penfed's handling of everything, IMO)

| Quote : | | "I believe you can go in anytime their rates decrease, pay them a $200 fee and lock in at the new, lower rate." |

unless something has changed, i don't think that's quite right (though i could be wrong, as it's been more than a year since i looked into it)...at the time, the only option was a one-time 1% rate drop for 0.75% of the loan value (ie. dropping from 4.75% to 3.75% on a $100k loan would cost $750 and reset your 2-year cycle)

as i said, that may have changed or they might offer different options now 5/28/2013 9:43:30 AM 5/28/2013 9:43:30 AM

|

stopdropnrol

All American

3908 Posts

user info

edit post |

Went forward with secus arm only to realize coastal cu has arm rates that are a whole 2% lower. Figure if they'll take a chance with me ill do the same with them&Still doing better than fha. I can refinance after a couple yrs. Speaking of which what recourse do banks/unions have other than the refi fees to keep people from jumping from arm to arm?  6/1/2013 5:50:43 PM 6/1/2013 5:50:43 PM

|

BigMan157

no u

103352 Posts

user info

edit post |

does penfed have pmi?  6/1/2013 7:09:52 PM 6/1/2013 7:09:52 PM

|

quagmire02

All American

44225 Posts

user info

edit post |

^ unless you're doing 80% LTV, yes...it's supposed to be dropped automatically when you hit 80%  6/3/2013 7:07:38 AM 6/3/2013 7:07:38 AM

|

wdprice3

BinaryBuffonary

45908 Posts

user info

edit post |

legally has to be dropped at 78%.  6/3/2013 8:18:43 AM 6/3/2013 8:18:43 AM

|

quagmire02

All American

44225 Posts

user info

edit post |

yeah...i thought they wouldn't drop it until then, but i verified with them that it would be dropped automatically at 80%...the rep said it should and she's never heard of it not, but if it isn't, to call them and let them know i was at the 80% LTV mark  6/3/2013 8:21:59 AM 6/3/2013 8:21:59 AM

|

David0603

All American

12759 Posts

user info

edit post |

| Quote : | | "coastal cu has arm rates that are a whole 2% lower." |

What's the rate? 6/3/2013 2:23:01 PM 6/3/2013 2:23:01 PM

|

stopdropnrol

All American

3908 Posts

user info

edit post |

coastal is 2.625% on their 5/5 arm secu is 4.25 on their 2yr arm. Quick appraisal questions. How do appraisers accurately account for the condition of comps without going inside the properties? Also I know appraisals affect the taxes you pay, but do the taxes you pay affect your appraisal? i.e. the property is nestled in a pocket of county within the city and has much lower taxes than many of the surrounding properties.

[Edited on June 4, 2013 at 8:28 AM. Reason : .]  6/4/2013 8:13:42 AM 6/4/2013 8:13:42 AM

|

CalledToArms

All American

22025 Posts

user info

edit post |

as far as how do they accurately account for condition? They don't. It goes back to something I said on the first page:

| Quote : | "appraisals vs what someone is willing to pay are obviously very different. Most appraisals for tax or mortgage reasons are pretty high-level black magic with not a lot of real specifics imo. They aren't always like that, bust most of them seem to be that way. It's no better than Zillow's Zestimate.

When you start getting into determining how much a house will actually sell for, that's a totally different ballgame and things like landscaping can obviously come into play.

" |

an appraisal for the purpose you are looking at is a "drive-by" level appraisal. Appraisal for tax or mortgages != what someone would actually be willing to pay for a house and is nothing more than a black-magic ballpark average. When you actually get into buying/selling houses, THEN the condition plays a factor a little more. Someone selling a house with a new roof, new floors, new kitchen etc. will be demanding a $/ft2 higher than the average. When the buyer throws comps at you to drive the price down, the seller will attempt to prove why their house is nicer than the comps the buyer is trying to use etc. You won't get into that at the mortgage level.

[Edited on June 4, 2013 at 8:31 AM. Reason : ] 6/4/2013 8:30:06 AM 6/4/2013 8:30:06 AM

|

stopdropnrol

All American

3908 Posts

user info

edit post |

so you're saying when a bank sends an appraiser out to a property(for loan purposes) it doesn't matter if the homes innards have been completely renovated, it's value will still be partly based on what the sister home down the street with ratty carpet,old fixtures and wall to wall wood paneling sold for?

seems pretty shitty now I'm worried about my appraisal coming back low based on what zillow and a few other sites are giving me.

[Edited on June 4, 2013 at 9:52 AM. Reason : .]  6/4/2013 9:49:59 AM 6/4/2013 9:49:59 AM

|

quagmire02

All American

44225 Posts

user info

edit post |

as noted, mortgage appraisals vary quite a bit...here's my anecdotal two cents:

my house appraised for around 3% more (i think) than i paid for it back in 2008...the appraiser never came inside and just walked around for 10 minutes

for this most recent appraisal, it's 6% higher than i paid...but the appraiser came inside and was there for more than 30 minutes overall

despite all of that, my tax value is about 80% of what i paid and the z-estimate from zillow puts the market value of the house at 83% of what i paid (and 78% of what it just appraised for a couple of months ago)

in short: appraisals are extremely rough ballpark figures, which is really annoying, depending on what you need them for   6/4/2013 9:58:27 AM 6/4/2013 9:58:27 AM

|

CalledToArms

All American

22025 Posts

user info

edit post |

yep haha. exactly.

I am not sure what the rules are these days, but the appraiser for our mortgage never came inside the house and certainly didn't know the inside conditions of any comps they were using. So yes, it will still be largely based on the comps, of which they have no real knowledge of. They just looked at it from the outside to make sure there was nothing glaring that would make the price of the sale appear way off.

As I said, where it really comes into play is when you are actually determining the buying/selling price of a house. If buyers are trying to justify why your house is overpriced because the home down the street is listed at $10,000 less, that's when you remind them that the home down the street has "ratty carpet, old fixtures and wall to wall wood paneling." Or if you are trying to get more than the average comp in your area, you can try and justify your price by all the upgrades you have in your house. It's not a guarantee but it's more concrete than the "appraisal" process.

[Edited on June 4, 2013 at 12:25 PM. Reason : ]  6/4/2013 12:09:41 PM 6/4/2013 12:09:41 PM

|