|

Message Boards »

»

The Impressive U.S. Economy

|

Page 1 ... 23 24 25 26 [27] 28 29 30 31 ... 47, Prev Next

|

drunknloaded

Suspended

147487 Posts

user info

edit post |

ok whats the dream best case scenario?

like when are we gonna be near the top of the peak again?  12/11/2008 6:17:19 PM 12/11/2008 6:17:19 PM

|

Prawn Star

All American

7643 Posts

user info

edit post |

we gotta hit the bottom first, and then start a recovery. We're still headed in the wrong direction.

It'll be a while.  12/11/2008 6:29:02 PM 12/11/2008 6:29:02 PM

|

drunknloaded

Suspended

147487 Posts

user info

edit post |

i dont see it going much more rock bottom than this...like 6 months tops  12/11/2008 6:36:52 PM 12/11/2008 6:36:52 PM

|

IMStoned420

All American

15485 Posts

user info

edit post |

Stocks are going to take a fucking beating today.  12/12/2008 9:20:19 AM 12/12/2008 9:20:19 AM

|

LoneSnark

All American

12317 Posts

user info

edit post |

| Quote : | "^^ I think it is referring to GDP minus the debt used by companies and individuals to support that GDP. i.e. lines of credit that are still open and growing to buy shit, the same shit that accounts for the GDP.

If my credit card bill has grown from $1k to $10k in the past 8 years, then technically I have contributed $9k to the GDP, but if I can't or won't pay that balance off, have I really contributed anything?" |

Again, you are making a fundamental mistake. You borrowing $9k and spending it contributed something less than $9k to the GDP. In fact, it is possible that your borrowing and spending actually REDUCED the GDP over those 8 years. The economy of the United States consists of more than just you and your credit card. That $9k you borrowed came from someone else, what they would have done with it had you not borrowed it is unknown; maybe they would have spent it themselves, contributing the $9k to GDP without incurring any debt, maybe they would have loaned it to small business owner that used it to buy productivity enhancing equipment, and maybe they would have used it to pay down their own debts.

And if you default on your debt, then you have harmed the people you borrowed $9k from, as they are $9k poorer; but you have made yourself $9k richer, so in economic terms society is no worse off from this single transaction (ignoring possible effects where-by the card company goes under and refuses cards to small business which wanted to buy productivity enhancing equipment). 12/12/2008 9:21:27 AM 12/12/2008 9:21:27 AM

|

Socks``

All American

11792 Posts

user info

edit post |

LoneSnark

| Quote : | | "Again, you are making a fundamental mistake. You borrowing $9k and spending it contributed something less than $9k to the GDP." |

Technically, this is incorrect. All $9,000 would have been included in GDP as part of it consumption component. It doesn't matter where you got it or what the opportunity cost was.

You have to remember that GDP is not a measure of welfare, only of spending/income. If I steal $9,000 from you and spend it on booze this will be counted as $9,000 in the consumption component of GDP. However, it is likely that this would result in a net welfare reduction (and unless you were going to just keep in your matress, it would have eventually showed up in GDP when you spent it yourself anyways).

But I think I see what you're getting at. If you invested the $9,000 in capital, rather than spending it, GDP would be even higher after 8 years than it was after only spending it (because labor is more productive after the creation of the capital and can therefore produce more stuff, which means more income/spending to be counted by GDP). I guess that could be true. Though it doesn't always have to be the case (there are such things as bad investments and diminishing returns).

[Edited on December 12, 2008 at 9:44 AM. Reason : ``] 12/12/2008 9:40:43 AM 12/12/2008 9:40:43 AM

|

ssjamind

All American

30098 Posts

user info

edit post |

| Quote : | | "^ it's been "coming" for 6 or 7 years." |

its been setting up for 6 or 7 years. now its materializing.

mark my words and the date at which i said them. 12/12/2008 5:26:52 PM 12/12/2008 5:26:52 PM

|

Prawn Star

All American

7643 Posts

user info

edit post |

^I'm confused about what you are trying to say. The dollar had been dropping for the past 6 or 7 years before the trend reversed at the end of the summer. Now the dollar is gaining against most other currencies.

Do you expect that trend to reverse once again, in the midst of a global recession that is likely to impact many other countries far more than us? What is a dollar "crash" if 7 years of devaluation doesn't qualify?

| Quote : | | "Stocks are going to take a fucking beating today." |

Dow up 65 points today, mostly due to rosy outlook for tech stocks.

[Edited on December 12, 2008 at 6:26 PM. Reason : 2] 12/12/2008 6:24:33 PM 12/12/2008 6:24:33 PM

|

IMStoned420

All American

15485 Posts

user info

edit post |

Maybe those countries are trying to prop up the dollar because they realize if the US economy goes to shit, then the entire world economy will go to shit. It doesn't seem like it's working either.  12/13/2008 2:23:43 PM 12/13/2008 2:23:43 PM

|

agentlion

All American

13936 Posts

user info

edit post |

i was just catching up on some old Colbert Reports, and just watched the one from November 19 where Colber talks about Phil Gramm's comments about the economy. Gramm says: "The markets have worked better than you might have thought"

Colbert's response reminds me of the idealouges here still trying to defend how "impressive" our economy is:

"It's true. You might have thought that by now we'd be driving spike-covered motorcycles over a barren hellscape, sword fighting over food and gas, wearing jackets made of human skin. But..... we are not. Thank you free market."

http://www.comedycentral.com/colbertreport/full-episodes/index.jhtml?episodeId=209956  12/20/2008 3:50:14 PM 12/20/2008 3:50:14 PM

|

LoneSnark

All American

12317 Posts

user info

edit post |

12/20/2008 7:02:10 PM 12/20/2008 7:02:10 PM

|

hooksaw

All American

16500 Posts

user info

edit post |

A ray of sunshine!

Experts: Economy will begin recovery in late 2009

| Quote : | | "RALEIGH, N.C. — Economists for the North Carolina Bankers Association and the North Carolina Chamber said they expect the state and national economies to begin recovering from their dismal showings of 2008." |

| Quote : | | "Martin Regalia, chief economist for the U.S. Chamber of Commerce, said he expects the economy to bottom out in the next few months before starting to grow again in the second half of the year." |

http://www.wral.com/news/local/story/4243997/

So I was off by a few months--nobody's perfect. And these economic expectations indicate how impressive our economy truly is.

---------------------------------------------------------------------------------

| Quote : | "An economic slowdown? Yes--somewhat. A recession? No--bank on it.

[hooksaw]

12/2/2007 4:11:17 AM" |

| Quote : | | "I guess if the bank was WAMU" |

slamjamason

This was a great line--very funny. You have received your due and proper.

In my defense, however, I did allow a bit of wiggle room:

| Quote : | "It's only Q1 of '08. Until I see two or more consecutive quarters of flat or negative growth in the GDP, a recession has not happened. And even if it does, the impressive U.S. economy will weather it well. I mean, how many economies would have remained as good as the U.S. economy has with all that it's been through these last few years?

1/8/2008 11:34:12 AM" |

http://thewolfweb.com/message_topic.aspx?topic=500489&page=6

| Quote : | "Hey, if you want to talk economic slowdown in the United States, we can. Obviously, such has happened, and I think we'll see a continuation of the slowing down in various indices from Q1 '08 through possibly Q2 or Q3 '08.

2/4/2008 12:40:27 AM" |

http://thewolfweb.com/message_topic.aspx?topic=500489&page=6

| Quote : | "Taking bets on how long it takes hooksaw to come into the thread and admit he was wrong.

I'm betting on -Never-" |

StankinMonky

http://thewolfweb.com/message_topic.aspx?topic=500489&page=25

What am I admitting to being wrong about, douche?

---------------------------------------------------------------------------------

FWIW, don't let people tell you there's no money out there. We made an offer a few weeks ago on a new townhouse that was in the $250K range. We asked the lender to cap the amount of the loan--they wanted to give us even more!

If you're qualified, there's money to be had. In addition, there are winners and losers in every economy, whether it's a good or bad economy. Now is a great time to buy big-ticket items such as a house, a car, or appliances--there are great deals out there to be had.   1/6/2009 2:28:21 AM 1/6/2009 2:28:21 AM

|

SandSanta

All American

22435 Posts

user info

edit post |

Being right or wrong on a general prediction isn't really an indicator that you contributed any value to the discussion. I could say "NC State will win a national championship sometime!" and be right when the chess club does indeed win a national championship in 2020.

As for 'the impressive US economy', nobody intelligent actually sat and argued with you that the economy was a 3rd world sham dressed up in pretty power points.

We just railed on you nonstop for posting daily 'positive news' as if it somehow proved your vacant point.

This thread then, ironically, has become a rolling troll of you by you. A tribute to your own absurdity.  1/6/2009 2:45:17 AM 1/6/2009 2:45:17 AM

|

hooksaw

All American

16500 Posts

user info

edit post |

| Quote : | | "Being right or wrong on a general prediction isn't really an indicator that you contributed any value to the discussion. I could say 'NC State will win a national championship sometime!' and be right when the chess club does indeed win a national championship in 2020." |

You mean like Schiff?

| Quote : | | "We just railed on you nonstop for posting daily 'positive news' as if it somehow proved your vacant point." |

My posts were usually in response to "negative news" posts. And my point that the U.S. economy is "impressive" is subjective, not vacant--not that I expect you to comprehend the difference.

| Quote : | | "This thread then, ironically, has become a rolling troll of you by you. A tribute to your own absurdity." |

You don't even know the meaning of the word "irony." In any event, if this thread is indeed a "tribute to [my] own absurdity," where does that leave you?

Shut. .the fuck. . .up.   1/6/2009 3:51:35 AM 1/6/2009 3:51:35 AM

|

nattrngnabob

Suspended

1038 Posts

user info

edit post |

| Quote : | | "And my point that the U.S. economy is "impressive" is subjective, not vacant--not that I expect you to comprehend the difference." |

Subjective to what? Other economies stock markets that fell by more or less the same amount as most of our major indices? You have economists and various other folks saying look to emerging markets and international ETFs this year for potentially better gains than in our own equities. If you're going to be subjective, how about you start laying out your metrics. Wait, don't worry about it, because it will inevitably end up with you getting clowned even harder than you have been already. 1/6/2009 9:45:08 AM 1/6/2009 9:45:08 AM

|

agentlion

All American

13936 Posts

user info

edit post |

| Quote : | "

So I was off by a few months--nobody's perfect. And these economic expectations indicate how impressive our economy truly is.

" |

so now you take your talking points from North Carolina Bankers Association and the North Carolina Chamber? Most natioinally known economists I've read think that there will be little to no recovery in 2009, and 09 could be worse than 08. Most people who say "the economy will recover in 2009" are only saying that based on historical averages - most receissions last 10-14 months, in 2009 it will be longer than that since our recession began, therefore it will end in 2009.

That's bullshit - this recession is not just a natural business-cycle dip, where it will pop back up in a couple months and everything will be peachy. This recession was brought on by a broken and corrupt financial market. Until the root causes of it are addressed, nothing is going to change.

----

| Quote : | | "What am I admitting to being wrong about, douche? " |

THIS, YOU FUCKING DUMB OLD MAN

| Quote : | | ""An economic slowdown? Yes--somewhat. A recession? No--bank on it." |

[Edited on January 6, 2009 at 10:04 AM. Reason : .] 1/6/2009 10:02:46 AM 1/6/2009 10:02:46 AM

|

hooksaw

All American

16500 Posts

user info

edit post |

^ 1. Fuck you.

2. The U.S. economy was, is, and will continue to be impressive.

3. I was wrong about the recession. In my defense, I presented hard facts and sound opinions to support my position--and I wasn't the only reasonably intelligent to highly intelligent person who didn't see it coming as bad as it has.

4. FWIW, concerning your mancrush on Peter Schiff, if you predict doom and gloom long enough, one day you'll be right. To his credit, at least Schiff gets this much--were you aware of this?

Don't Blame Capitalism

| Quote : | "For the political left, which has long championed the need for such limits, this crisis is the opportunity of a lifetime.

Absent from such conclusions is the central role the government played in creating the crisis. Yes, many Wall Street leaders were irresponsible, and they should pay. But they were playing the distorted hand dealt them by government policies. Our leaders irrationally promoted home-buying, discouraged savings, and recklessly encouraged borrowing and lending, which together undermined our markets." |

| Quote : | | "The United States reached its economic preeminence on the strength of its free markets. So far, the economic disaster exacerbated by government policies is creating opportunities for further government interference, which will lead to bigger catastrophes. Binding the country to a tangle of socialist ideals will seal our fate as a second-rate economic power." |

http://www.washingtonpost.com/wp-dyn/content/article/2008/10/15/AR2008101503166.html

5. And if some of you were candid--for once--you'd admit that you hadn't really formed much of an opinion about the coming state of the economy other than a generally negative outlook of "FUCK THE WAR!" and "FUCK BUSH!" and "LET'S PIN IT ALL ON THAT COCKSUCKER!"

And don't even start with me that this isn't the fucking case! The New York Slimes--among other left-wing entities--has been blaming Bush for everything wrong with the economy for weeks now:

THE RECKONING

White House Philosophy Stoked Mortgage Bonfire

http://www.nytimes.com/2008/12/21/business/21admin.html

How fucking disingenuous.   1/7/2009 4:19:25 AM 1/7/2009 4:19:25 AM

|

nattrngnabob

Suspended

1038 Posts

user info

edit post |

| Quote : | | "4. FWIW, concerning your mancrush on Peter Schiff, if you predict doom and gloom long enough, one day you'll be right. To his credit, at least Schiff gets this much--were you aware of this?" |

You we're saying nearly the exact same thing in the beginning of the thread that will go down in history as one massive clowning of yourself. It isn't like he was saying "wow, the stock market is really high...ummm...I bet it's gonna correct itself a little".

| Quote : | | "3. I was wrong about the recession. In my defense, I presented hard facts and sound opinions to support my position--and I wasn't the only reasonably intelligent to highly intelligent person who didn't see it coming as bad as it has." |

In other words, with hard facts in hand you drew massively incorrect conclusions. Is that because you're an economic infant?

| Quote : | "5. And if some of you were candid--for once--you'd admit that you hadn't really formed much of an opinion about the coming state of the economy other than a generally negative outlook of "FUCK THE WAR!" and "FUCK BUSH!" and "LET'S PIN IT ALL ON THAT COCKSUCKER!"

And don't even start with me that this isn't the fucking case! The New York Slimes--among other left-wing entities--has been blaming Bush for everything wrong with the economy for weeks now:

THE RECKONING

White House Philosophy Stoked Mortgage Bonfire" |

I don't agree with a ton in that article, but the Bush administration had 8 years...8 fucking years to do something...anything about the growing housing bubble. They were warned about the problem and actively ignored it. They did listen to their Wall Street cronies who wanted to lever up to the moon. They did listen to their Wall Street cronies who cried for a bailout and got it with hardly any discussion and no oversight.

We don't know how it would have played out different had they decided to anything about anything, but we do know how it turned out from not doing anything. And it's pretty shitty. 1/7/2009 7:31:38 AM 1/7/2009 7:31:38 AM

|

LoneSnark

All American

12317 Posts

user info

edit post |

^ Let us be fair. Would anyone else have done anything differently?

Everything you vehimently blame Bush for enjoyed complete bi-partisan support. Everything, from ignoring the problem to bailing out the causes. As such, an Al Gore or John Kerry in the white house would not have changed anything but which side of the issue Republicans fell upon. If it had been a democrat pushing the bailout a few more republicans would have balked and a few more democrats would have supported the measures to no effect.

As such, blame those really responsible: the entire city of Washington.  1/7/2009 10:39:06 AM 1/7/2009 10:39:06 AM

|

Hunt

All American

735 Posts

user info

edit post |

| Quote : | | "but the Bush administration had 8 years...8 fucking years to do something...anything about the growing housing bubble." |

| Quote : | | "We don't know how it would have played out different had they decided to anything about anything, but we do know how it turned out from not doing anything. And it's pretty shitty." |

What would you propose? Per my post in another thread, it is wishful thinking to believe the regulators could have caught this. Everyone was using the same data and based their decisions on the same conclusion. Regulators are no different.

Additionally, we are now finding out that government policies vastly exacerbated the crisis, if not outright caused it.

message_topic.aspx?topic=554341

| Quote : | "

Deregulation/Lack of regulation

While it is comforting to think that regulators have greater omniscience than the millions of market participants with huge sums of their own money at stake, there is little evidence to believe additional regulations could have prevented the housing bubble and subsequent credit crisis. There is little tenable evidence that deregulation caused the current crisis or that a lack of regulation could have prevented it. (Let us not forget that two of the most highly-regulated entities, Fannie Mae and Freddie Mac, were also the most insolvent) As for deregulation, there were few regulations removed over the last decade and there is little evidence that those few had any substantial impact on the current crisis. Additionally, if lax regulations in the United States caused the financial crisis, we would see a direct correlation between economic contraction and the strength of regulatory bodies in other countries. Surely European banks, with heavier regulatory oversight, would have fared better than their allegedly loose-regulated US counterparts. The fact that financial systems around the world, each with varying degrees of regulation, have experienced the same stress suggests the level of regulation is irrelevant.

Ability to accurately measure risk

In my opinion, what played the biggest role in perpetuating housing investment and led to under-capitalized banks was the misinterpretation of risk. With 20/20 hindsight, it would appear that the financial industry should have seen this coming. A further look, however, shows their risk management was misguided, but not irrational.

The single piece of evidence that influenced home buyers to continue coming to the market, financial institutions to continue issuing mortgages and investors to continue buying mortgage-backed securities (MBS) was the very-long, historical record of home-price appreciation. The data below was what was primarily used by these participants in their decision-making.

Again, in retrospect this seems irrational. But don’t we do this every day with a host of other decisions? Many of us consume certain chemicals, like NutraSweet or Splenda, with the belief that past data accurately reflects its risks. For those that bought houses in areas like California and Florida, they rationally believed that, while prices will not continue their trajectory, they will not fall in value. We now know people were too reliant on historical data.

While imprudent, I do not think it is necessarily irrational. As for the banks, MBS investors, and regulators, they, too, were using historical data to assess their portfolio risk. While they may have stress-tested falling home prices in certain areas of the country, they believed a portfolio of mortgages would provide the necessary diversification to prevent overall deterioration. (For those familiar with modern-portfolio theory, the correlation of assets was underestimated, again because of the emphasis on historical data) It was not greed or short-term gains that made them take what we now know to be excessive risk, but rather the inability to conceive of an event they had not seen in their lifetimes. (i.e. a black-swan event). For a great article on the banks’ risk-management practices, specifically regarding value-at-risk (VaR), see: http://www.nytimes.com/2009/01/04/magazine/04risk-t.html?_r=3&pagewanted=all) " |

1/7/2009 10:42:55 AM 1/7/2009 10:42:55 AM

|

nattrngnabob

Suspended

1038 Posts

user info

edit post |

| Quote : | | "^ Let us be fair. Would anyone else have done anything differently? " |

We don't really know. We don't know if a Democrat Pres or Congress would have really said no to the relaxing of the leverage limits of the very iBanks that went bust. We don't really know if they would have listened to the massive amount of lobbying money that no doubt poured in to keep the gravy train running. We don't know if they would have been receptive to the warnings before congressional committees that things weren't sustainable. We do know that Bush and Company failed, so they deserve blame. To try and make this a hypothetical about the other evil is a waste of everyone's time.

| Quote : | | "What would you propose? Per my post in another thread, it is wishful thinking to believe the regulators could have caught this. Everyone was using the same data and based their decisions on the same conclusion." |

I'd propose the fed and economic policy makers be just as pertinent about stable growth, inflation, and employment during boom times as they are during recessions. I'm not sure what data and conclusions you are referring to as not everyone was drawing the same ones. 1/7/2009 10:55:53 AM 1/7/2009 10:55:53 AM

|

agentlion

All American

13936 Posts

user info

edit post |

| Quote : | | "We don't know if a Democrat Pres or Congress would have really said no to the relaxing of the leverage limits of the very iBanks that went bust." |

well, we kind of do know that....

Hank Paulson, as CEO of Goldman Sachs, went personally to the SEC in 2000, under Clinton's SEC appointment, and asked for relaxed leverage limits. He was rejected.

He returned in 2004 under Bush's SEC appointment, and was accepted. Limits were raised from 12:1 to, what - 40:1, 60:1 - on 5, and only 5, Investment Banks, all of which no longer exist in that form.

| Quote : | | "Additionally, we are now finding out that government policies vastly exacerbated the crisis, if not outright caused it." |

anyone who claims that it was a good idea to completely deregulate the $62 Trillioin of Credit Default Swaps (i.e. "financial weapons of mass destruction") is out of their mind. 1/7/2009 11:13:03 AM 1/7/2009 11:13:03 AM

|

Hunt

All American

735 Posts

user info

edit post |

The 62-odd trillion is the gross notional amount, not net exposure. As per the Lehman settlement, net exposure is but a fraction of total notional amount. The CDS market is far more sound than some alarmist like to portend.

What the system needs is more transparency. Financial institutions do not know the net exposure of their counterparties, thus are unable to fully asses counterparty risks. There are already private initiatives to correct this, but facilitation from regulators, I think, would be welcome by the industry.

By the way, Buffet, who coined the phrase "financial weapons of mass destruction," already claimed ignorance of the CDS market. What sense does it make, then, to take his analysis seriously? If a prominent author doesn't understand the concept of ebooks, should we consider his analysis of the ebook industry prophetic?

[Edited on January 7, 2009 at 12:35 PM. Reason : .]  1/7/2009 12:21:29 PM 1/7/2009 12:21:29 PM

|

ssjamind

All American

30098 Posts

user info

edit post |

someone in chichat posted LOL:

http://politicalticker.blogs.cnn.com/2009/01/07/porn-industry-seeks-federal-bailout/  1/7/2009 3:22:46 PM 1/7/2009 3:22:46 PM

|

WillemJoel

All American

8006 Posts

user info

edit post |

I fucking loathe Bush.

but it annoys the piss out of me when people pin all of our economic woes on him. Sure, neglect played a part, but there are so many other factors involved, on which a few people have touched on in this thread.

[Edited on January 8, 2009 at 8:59 AM. Reason : asfdasfasf]  1/8/2009 8:56:58 AM 1/8/2009 8:56:58 AM

|

drunknloaded

Suspended

147487 Posts

user info

edit post |

http://www.forbes.com/opinions/2009/01/07/recession-stimulus-spending-oped-cx_nr_0108roubini.html

this guy paints a pretty bad picture  1/8/2009 10:46:53 AM 1/8/2009 10:46:53 AM

|

LunaK

LOSER :(

23634 Posts

user info

edit post |

CNN is showing IOUSA (http://www.iousathemovie.com/) it's really interesting  1/10/2009 2:12:46 PM 1/10/2009 2:12:46 PM

|

drunknloaded

Suspended

147487 Posts

user info

edit post |

haha the steve parnell/steve martin/amy phoeler(sp?) snl clip was good

where exactly do we get this "saved" money?  1/10/2009 2:33:46 PM 1/10/2009 2:33:46 PM

|

spöokyjon

ℵ

18617 Posts

user info

edit post |

1/10/2009 3:00:31 PM 1/10/2009 3:00:31 PM

|

hooksaw

All American

16500 Posts

user info

edit post |

Just the Facts: The Administration's Unheeded Warnings About the Systemic Risk Posed by the GSEs

| Quote : | "For many years the President and his Administration have not only warned of the systemic consequences of financial turmoil at a housing government-sponsored enterprise (GSE) but also put forward thoughtful plans to reduce the risk that either Fannie Mae or Freddie Mac would encounter such difficulties. President Bush publicly called for GSE reform 17 times in 2008 alone before Congress acted. Unfortunately, these warnings went unheeded, as the President's repeated attempts to reform the supervision of these entities were thwarted by the legislative maneuvering of those who emphatically denied there were problems.

2001

April: The Administration's FY02 budget declares that the size of Fannie Mae and Freddie Mac is "a potential problem," because "financial trouble of a large GSE could cause strong repercussions in financial markets, affecting Federally insured entities and economic activity."

2002

May: The President calls for the disclosure and corporate governance principles contained in his 10-point plan for corporate responsibility to apply to Fannie Mae and Freddie Mac. (OMB Prompt Letter to OFHEO, 5/29/02)

2003

January: Freddie Mac announces it has to restate financial results for the previous three years.

February: The Office of Federal Housing Enterprise Oversight (OFHEO) releases a report explaining that "although investors perceive an implicit Federal guarantee of [GSE] obligations," "the government has provided no explicit legal backing for them." As a consequence, unexpected problems at a GSE could immediately spread into financial sectors beyond the housing market. ("Systemic Risk: Fannie Mae, Freddie Mac and the Role of OFHEO," OFHEO Report, 2/4/03)

September: Fannie Mae discloses SEC investigation and acknowledges OFHEO's review found earnings manipulations.

September: Treasury Secretary John Snow testifies before the House Financial Services Committee to recommend that Congress enact "legislation to create a new Federal agency to regulate and supervise the financial activities of our housing-related government sponsored enterprises" and set prudent and appropriate minimum capital adequacy requirements.

October: Fannie Mae discloses $1.2 billion accounting error.

November: Council of the Economic Advisers (CEA) Chairman Greg Mankiw explains that any "legislation to reform GSE regulation should empower the new regulator with sufficient strength and credibility to reduce systemic risk." To reduce the potential for systemic instability, the regulator would have "broad authority to set both risk-based and minimum capital standards" and "receivership powers necessary to wind down the affairs of a troubled GSE." (N. Gregory Mankiw, Remarks At The Conference Of State Bank Supervisors State Banking Summit And Leadership, 11/6/03)

2004

February: The President's FY05 Budget again highlights the risk posed by the explosive growth of the GSEs and their low levels of required capital, and called for creation of a new, world-class regulator: "The Administration has determined that the safety and soundness regulators of the housing GSEs lack sufficient power and stature to meet their responsibilities, and therefore…should be replaced with a new strengthened regulator." (2005 Budget Analytic Perspectives, pg. 83)

February: CEA Chairman Mankiw cautions Congress to "not take [the financial market's] strength for granted." Again, the call from the Administration was to reduce this risk by "ensuring that the housing GSEs are overseen by an effective regulator." (N. Gregory Mankiw, Op-Ed, "Keeping Fannie And Freddie's House In Order," Financial Times, 2/24/04)

June: Deputy Secretary of Treasury Samuel Bodman spotlights the risk posed by the GSEs and called for reform, saying "We do not have a world-class system of supervision of the housing government sponsored enterprises (GSEs), even though the importance of the housing financial system that the GSEs serve demands the best in supervision to ensure the long-term vitality of that system. Therefore, the Administration has called for a new, first class, regulatory supervisor for the three housing GSEs: Fannie Mae, Freddie Mac, and the Federal Home Loan Banking System." (Samuel Bodman, House Financial Services Subcommittee on Oversight and Investigations Testimony, 6/16/04)

2005

April: Treasury Secretary John Snow repeats his call for GSE reform, saying "Events that have transpired since I testified before this Committee in 2003 reinforce concerns over the systemic risks posed by the GSEs and further highlight the need for real GSE reform to ensure that our housing finance system remains a strong and vibrant source of funding for expanding homeownership opportunities in America… Half-measures will only exacerbate the risks to our financial system." (Secretary John W. Snow, "Testimony Before The U.S. House Financial Services Committee," 4/13/05)" |

[Edited on January 10, 2009 at 7:16 PM. Reason : Cont. below.] 1/10/2009 7:15:56 PM 1/10/2009 7:15:56 PM

|

hooksaw

All American

16500 Posts

user info

edit post |

| Quote : | "2007

July: Two Bear Stearns hedge funds invested in mortgage securities collapse.

August: President Bush emphatically calls on Congress to pass a reform package for Fannie Mae and Freddie Mac, saying "first things first when it comes to those two institutions. Congress needs to get them reformed, get them streamlined, get them focused, and then I will consider other options." (President George W. Bush, Press Conference, The White House, 8/9/07)

September: RealtyTrac announces foreclosure filings up 243,000 in August – up 115 percent from the year before.

September: Single-family existing home sales decreases 7.5 percent from the previous month – the lowest level in nine years. Median sale price of existing homes fell six percent from the year before.

December: President Bush again warns Congress of the need to pass legislation reforming GSEs, saying "These institutions provide liquidity in the mortgage market that benefits millions of homeowners, and it is vital they operate safely and operate soundly. So I've called on Congress to pass legislation that strengthens independent regulation of the GSEs – and ensures they focus on their important housing mission. The GSE reform bill passed by the House earlier this year is a good start. But the Senate has not acted. And the United States Senate needs to pass this legislation soon." (President George W. Bush, Discusses Housing, The White House, 12/6/07)

2008

January: Bank of America announces it will buy Countrywide.

January: Citigroup announces mortgage portfolio lost $18.1 billion in value.

February: Assistant Secretary David Nason reiterates the urgency of reforms, says "A new regulatory structure for the housing GSEs is essential if these entities are to continue to perform their public mission successfully." (David Nason, Testimony On Reforming GSE Regulation, Senate Committee On Banking, Housing And Urban Affairs, 2/7/08)

March: Bear Stearns announces it will sell itself to JPMorgan Chase.

March: President Bush calls on Congress to take action and "move forward with reforms on Fannie Mae and Freddie Mac. They need to continue to modernize the FHA, as well as allow State housing agencies to issue tax-free bonds to homeowners to refinance their mortgages." (President George W. Bush, Remarks To The Economic Club Of New York, New York, NY, 3/14/08)

April: President Bush urges Congress to pass the much needed legislation and "modernize Fannie Mae and Freddie Mac. [There are] constructive things Congress can do that will encourage the housing market to correct quickly by … helping people stay in their homes." (President George W. Bush, Meeting With Cabinet, the White House, 4/14/08)

May: President Bush issues several pleas to Congress to pass legislation reforming Fannie Mae and Freddie Mac before the situation deteriorates further.

"Americans are concerned about making their mortgage payments and keeping their homes. Yet Congress has failed to pass legislation I have repeatedly requested to modernize the Federal Housing Administration that will help more families stay in their homes, reform Fannie Mae and Freddie Mac to ensure they focus on their housing mission, and allow State housing agencies to issue tax-free bonds to refinance sub-prime loans." (President George W. Bush, Radio Address, 5/3/08)

"[T]he government ought to be helping creditworthy people stay in their homes. And one way we can do that – and Congress is making progress on this – is the reform of Fannie Mae and Freddie Mac. That reform will come with a strong, independent regulator." (President George W. Bush, Meeting With The Secretary Of The Treasury, the White House, 5/19/08)

"Congress needs to pass legislation to modernize the Federal Housing Administration, reform Fannie Mae and Freddie Mac to ensure they focus on their housing mission, and allow State housing agencies to issue tax-free bonds to refinance subprime loans." (President George W. Bush, Radio Address, 5/31/08)

June: As foreclosure rates continued to rise in the first quarter, the President once again asks Congress to take the necessary measures to address this challenge, saying "we need to pass legislation to reform Fannie Mae and Freddie Mac." (President George W. Bush, Remarks At Swearing In Ceremony For Secretary Of Housing And Urban Development, Washington, D.C., 6/6/08)

July: Congress heeds the President's call for action and passes reform of Fannie Mae and Freddie Mac as it becomes clear that the institutions are failing." |

http://www.whitehouse.gov/news/releases/2008/09/20080919-15.html

Congressman Barney Frank--chairman of the House Financial Services Committee--said Fannie and Freddie were "not in a crisis" and were "fundamentally sound" and he continued to push for "affordable housing":

http://www.youtube.com/watch?v=y56lGWvVsrc

NYT Front-Page Spread Blames Bush for "Mortgage Bonfire"

Two Bush-hostile reporters stack virtually all the blame for the mortgage meltdown on President Bush, despite actions by Congress and the previous Clinton administration.

| Quote : | | "Conspicuously absent from that brief blame list is Congress, and specifically Congress’s most ardent defenders of Fannie Mae and Freddie Mac, Democrat Rep. Barney Frank and Sen. Chris Dodd. Throughout the story the Times did the bare minimum of acknowledging the president’s attempts to regulate the quasi-government mortgage finance giants, then blaming him at the end." |

http://timeswatch.org/articles/2008/20081222105609.aspx

[Edited on January 10, 2009 at 7:37 PM. Reason : .] 1/10/2009 7:17:04 PM 1/10/2009 7:17:04 PM

|

Socks``

All American

11792 Posts

user info

edit post |

spookyjon,

Talk about overstatement.

OMG!!!! UNEMPLOYMENT IS UP TO 7%, THIS IS JUST LIKE THE FUCKING GREAT DEPRESSION!!!!11111

Of course, I'm sure the fear mongering by Democrats has nothing at all to do with trying to get their political agenda past the American people.

[Edited on January 10, 2009 at 7:45 PM. Reason : Things are bad. They are not that bad. Not even fucking close.]  1/10/2009 7:43:54 PM 1/10/2009 7:43:54 PM

|

nattrngnabob

Suspended

1038 Posts

user info

edit post |

U6 is up over 13%, part time employment has doubled over the course of 2008, those numbers are much more relevant than your U3 number. Please find some supporting evidence that they aren't.  1/10/2009 8:55:35 PM 1/10/2009 8:55:35 PM

|

spöokyjon

ℵ

18617 Posts

user info

edit post |

Socks``,

The reason I posted that picture is because that was some baller-ass protest sign penmanship going on. I just came across the picture and thought it was awesome. People should make signs of that caliber now. That being said, sorry to disturb the sand in your vagina.

luv,

jon  1/10/2009 10:16:09 PM 1/10/2009 10:16:09 PM

|

Dentaldamn

All American

9974 Posts

user info

edit post |

i agree some time was taken on those signs.  1/11/2009 2:21:59 PM 1/11/2009 2:21:59 PM

|

Socks``

All American

11792 Posts

user info

edit post |

natteringnaybob,

We already had this discussion. There are plenty of good reasons why U6 is not the best measurement of cyclical unemployment, no matter what you read on your favorite blogs. Primarily, there are plenty of reasons for people to move to part time that are unrelated to the business cycle. For example, if you're working at GM and you get shifted from full to part-time, this probably has more to do with the US losing its comparative advantage in auto-manufacturing than it does with the current recession (don't bother arguing this because I'm not in the mood to hear what you really think is going on). So, I will just focus on explaining to you why U6 is not helpful for comparing this recession to previous recessions.

U6 is mostly useless for comparing this recession to previous recessions because we only have data on U6 going back to the mid-1990's. As a result, we have no idea what U6 unemployment was during our worst recessions.

If we're talking about the Great Depression specifically (as I was), unemployment (as measured as people out of work, but actively seeking employment, a measure essentially the same as U3 though I don't know if it was called that at the time) reached about 25% at its peak. We can only guess how much larger U6 unemployment would have been measured at during this time, but by definition it would have been larger than 25% (more than twice the size of current U6 measurements). So, like I said, this recession is still NO WHERE CLOSE to what we experienced during the Great Depression.

http://www2.census.gov/prod2/statcomp/documents/CT1970p1-05.pdf

Please get off your U3-U6 hobby horse. Repeating what you read on The Big Picture doesn't impress me.  1/11/2009 2:49:06 PM 1/11/2009 2:49:06 PM

|

marko

Tom Joad

72749 Posts

user info

edit post |

i like the action-beacon lines around "not"  1/11/2009 3:03:03 PM 1/11/2009 3:03:03 PM

|

spöokyjon

ℵ

18617 Posts

user info

edit post |

marko,

Why do you hate America?  1/11/2009 3:33:10 PM 1/11/2009 3:33:10 PM

|

moron

All American

33731 Posts

user info

edit post |

| Quote : | | "So, like I said, this recession is still NO WHERE CLOSE to what we experienced during the Great Depression. " |

It's also very likely that we haven't hit the bottom yet. There are still "reactive" effects that have yet to be realized from our interactions with other countries' economies. 1/11/2009 3:40:49 PM 1/11/2009 3:40:49 PM

|

Socks``

All American

11792 Posts

user info

edit post |

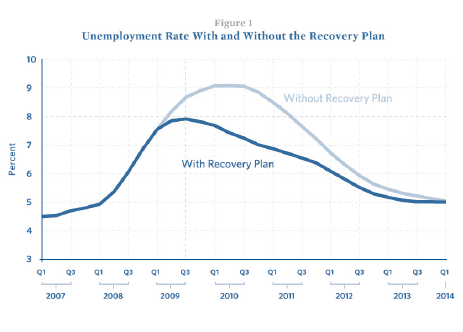

^ Even worst case scenarios projections don't show us reaching Depression-era unemployment levels. According to estimates by Christina Romer (chair of CEA) and Jared Bernstein, unemployment is predicted to reach 9% without a stimulus plan and they cite that some projections go as high as 11%. That is still far less than half of the Depression-era peak of 25% and there are still other projections that cite much lower numbers.

http://otrans.3cdn.net/45593e8ecbd339d074_l3m6bt1te.pdf

The reality is that we are possibly facing the worst recession since 1982. But there is almost no chance at all that we are looking at another Great Depression. The more you look at the numbers (instead of the rhetoric) the more you will realize that.

That isn't to down play our problems. Things will get pretty bad (and personally I believe there is very little the government can do about it that hasn't already been done). But we need to keep things in perspective. This is an economic slow down, not a total collapse. The Great Depression of the 1930's set the stage for Franklin Roosevelt and his Democratic congress to lead the greatest expansion of the federal government in the history of our union. An expansion that totally reshaped the role we expect government to play in our economy and in our lives. What has the 2008 recession set the stage for??? Building a lot of new roads and bridges.

[Edited on January 11, 2009 at 7:12 PM. Reason : ``]  1/11/2009 7:03:15 PM 1/11/2009 7:03:15 PM

|

moron

All American

33731 Posts

user info

edit post |

| Quote : | | "The reality is that we are possibly facing the worst recession since 1982. But there is almost no chance at all that we are looking at another Great Depression. The more you look at the numbers (instead of the rhetoric) the more you will realize that. " |

Who is saying we'll hit Great Depression levels?

It'd be nice in any case to not have to come close to those levels though.

Which means comparing the unemployment to recent past unemployment. And when we're at 16 year highs, that's not really the time, considering everything else going on, to just sit back and relax. 1/11/2009 7:54:32 PM 1/11/2009 7:54:32 PM

|

Socks``

All American

11792 Posts

user info

edit post |

^ i never said we should sit back and relax, i just said that comparing it to the Great Depression is unreasonable. And there are plenty of people doing it. Even if spookyjon is saying he only posted that picture because it looked cool (thanks Chit-Chat!), everyone from Paul Krugman to the fucking History Channel are drawing parallels between the two time periods. It's really unjustified (and if you agree with me about this, I'm not sure what you were complaining about).

Now, what should we do to ease the recession? Well, I personally don't think that there is much more we CAN do. As I noted in my previous thread, the primary causes of this recession are "supply side" shocks that a fiscal stimulus will not help. The fiscal stimulus might help correct for any reduction in aggregate demand that is caused by people panicing about these supply-side factors (which obviously has nothing to do with political fear-mongering on both sides of the aisle), but that isn't the biggest problem we're facing.

But don't take my word for it. Even according to Christina Romer, after BILLIONS of dollars of fiscal stimulus will STILL be left with an unemployment rate of 7.6% at the end of 2010, which is only 1% point lower than the 8.7% of unemployment that she expects without stimulus. And that's coming from someone that is supposedly OPTIMISTIC about the prospects of this package.

Is this really worth adding billions of dollars to the national debt? Especially considering the consequences that an aging population will have for future budget decisions (Medicare isn't actually free you know)? I personally have my doubts. The Democrats used to have their doubts too...until they started winning elections. I guess this is how you do it. Spend lots of money and hope people love you for it.

[Edited on January 11, 2009 at 8:42 PM. Reason : ``]  1/11/2009 8:38:14 PM 1/11/2009 8:38:14 PM

|

nattrngnabob

Suspended

1038 Posts

user info

edit post |

| Quote : | | "We already had this discussion. There are plenty of good reasons why U6 is not the best measurement of cyclical unemployment, no matter what you read on your favorite blogs." |

Maybe you did it already, but did you find any current expert opinion that effectively ignores U6 at this point in time (which is essentially what you are doing)? When things are stable and U3 is low, U6 doesn't really change in any significant way to matter. When things start to take a tumble, U6 captures faster the changing situation and lets us know better and quicker what the average Joe on the street is feeling. And I think you're a bit full of yourself when I can present right now 3-4 professional economists/traders/advisers (Krugman isn't one of them) who are keyed on U6 and you blithely ignore them like you know more about econ than they do? It's just another reason, like switching your politics every few days, you shouldn't be taken too seriously.

| Quote : | | "For example, if you're working at GM and you get shifted from full to part-time, this probably has more to do with the US losing its comparative advantage in auto-manufacturing than it does with the current recession (don't bother arguing this because I'm not in the mood to hear what you really think is going on)" |

rofl, you're an idiot.

| Quote : | | "If we're talking about the Great Depression specifically (as I was), unemployment (as measured as people out of work, but actively seeking employment, a measure essentially the same as U3 though I don't know if it was called that at the time) reached about 25% at its peak." |

I don't remember correctly, but I don't think I ever compared this slowdown to the depression, in fact, I think I am on record in here somewhere saying U3 could go to 10% and Lonesnark called me on it.

| Quote : | "

Please get off your U3-U6 hobby horse. Repeating what you read on The Big Picture doesn't impress me." |

Or Calculated Risk, Mish, Seeking Alpha, among others. 1/11/2009 11:20:41 PM 1/11/2009 11:20:41 PM

|

hooksaw

All American

16500 Posts

user info

edit post |

| Quote : | | "i like the action-beacon lines around 'not'" |

marko

LOL--nice! And some whiz lines after "Transients" would've been sweet!   1/11/2009 11:40:42 PM 1/11/2009 11:40:42 PM

|

Socks``

All American

11792 Posts

user info

edit post |

natteringnaybob,

appeals to authority do not convince me very much. "How many econ bloggers can you name that agree with your position!?!?" isn't a game i'm going to play. If you can deal with my criticisms of their arguments then do so.

Otherwise, quit strolling me. No matter how many times you ask, I'm not meeting you in the Bragaw restroom.  1/12/2009 12:40:27 AM 1/12/2009 12:40:27 AM

|

joe_schmoe

All American

18758 Posts

user info

edit post |

i'll see your "appeal to authority" and raise you an "ad hominem"

gg socks.

btw, dipshit, you still didnt explain how obama is "responsible" for the bailout.  1/12/2009 12:46:55 AM 1/12/2009 12:46:55 AM

|

hooksaw

All American

16500 Posts

user info

edit post |

Obama pledges major bailout changes

| Quote : | | "'The Obama administration wants to rebrand this exercise.'" |

http://www.google.com/hostednews/afp/article/ALeqM5hGEgMHJoSBlNAOvX50GkldQl4FrA

Despite some mismanagement of the TARP process, including a lack of transparency, as soon as this proposed "rebranding" happens, Obama may be seen to own the problem. But I think there's already plenty of blame to go around. 1/12/2009 1:47:44 AM 1/12/2009 1:47:44 AM

|

Socks``

All American

11792 Posts

user info

edit post |

joe_schmoe,

You should prob look up what "ad hominem" means. It would help in future discussions. Also, if you are unsatisfied with my previous response to your obtuse question, I apologize. I will do better next time. Have a nice day.

--Socks``  1/12/2009 5:58:38 AM 1/12/2009 5:58:38 AM

|

Kainen

All American

3507 Posts

user info

edit post |

This thread and many others in soap box brings to mind an excellent quote I saw over at TPM that really needs to be read and thought about. I see a lot of fucking posturing and throwing shit, instead of offering real solutions. I thought I would share it here.

| Quote : | "One of the most difficult dynamics in legislating is the seemingly never ending critique that the good is not perfect.

That argument is in constant use and is far too often an excuse to make the bad worse or not at all. As the debate heats up on the Recovery Plan, folks need to step back and get real pragmatic. As necessary as such a plan is, it is still a dangerous gamble and a deep mortgage on the future earnings of the polity, including some of whom are yet to be born.

I love Paul Krugman, but I would be much more interested in his suggestions and prescriptions than I am in his critiques (and yours too for that matter). The Recovery Plan has to thread a fine needle and deal with a bunch of conditions set in place by the Bush Administration. The Bush deficit predicted to be 1.2 Trillion this year. The Fed investment in monetary policy of almost 2 Trillion so far, the TARP use of 350 Billion with marginal or no results and a population that is largely untutored on the whys and wherefores of the economics of what went wrong and what we can realistically do to recover. Add to that the need to re-direct an already ailing economy, deal with entitlements and restructure and re-equip a fatigued military. The list goes on, schools, infrastructure, etc.

It's time for everyone with creditable and cogent suggestions to get down in the weeds and start talking specifics. How can we spend 1 Trillion plus in a timely manner that INVESTS in the national economy and not just temporarily stimulates it. How can we come to a national consensus on what to do and when.

In my mind this economic breakdown is as dangerous and impactful as the events of 9/11 and requires a united national response just as that event did. The task of the PE is to try to forge that national consensus and plan at a time when there is ever increasing skepticism over "bailouts" in general and big ones in particular.

It's time to, at the very least, couple your critique with constructive suggestions. I know that the role of the press is to point out the apparent and hidden factors and to raise awareness. But you (and Krugman) have an opportunity to add positive and creative input to the mix. Input that is sorely needed. If you don't know, then find someone who you believe does and bring their point of view forward.

Anyone paying attention, by now, knows how difficult and daunting the task. And those paying attention are also aware of the complexity and intricacy of the terrain. It's time for the chattering classes to add light and not just heat. Educate us, inform us, but also help us to see the solutions, not just the problem." |

1/12/2009 10:51:40 AM 1/12/2009 10:51:40 AM

|

joe_schmoe

All American

18758 Posts

user info

edit post |

Dearest Socks

thank you for your concern. although i suggest that perhaps you review the material before attempting to give a lecture.

for instance, when you avoid the question and instead bait the target with accusations of sexual impropriety

| Quote : | | "No matter how many times you ask, I'm not meeting you in the Bragaw restroom." |

if you cant recognize that as the most basic sort of ad hominem, then it is you who are in need of remedial after-school classes.

Sincerely,

Joe 1/12/2009 11:18:08 AM 1/12/2009 11:18:08 AM

|

|

|

Message Boards »

The Soap Box

»

The Impressive U.S. Economy

|

Page 1 ... 23 24 25 26 [27] 28 29 30 31 ... 47, Prev Next

|

|